- Bearish sentiment is still prevalent in the Bitcoin market

- Some metrics and whale actions may be the key to a price reversal

Bitcoin [BTC] The price fell back below $64,000, raising concerns about further decline on the charts. Now, although there are many factors at play, the likely reason behind the price correction mentioned above could be the recent actions of whales.

Bitcoin whales take profit

Market speculators have stepped up their game over the past 24 hours as the price of BTC has fallen on the charts. according to CoinMarketCapBitcoin was down more than 2% at press time, with the cryptocurrency trading at $63,042 with a market cap of more than $1.24 trillion.

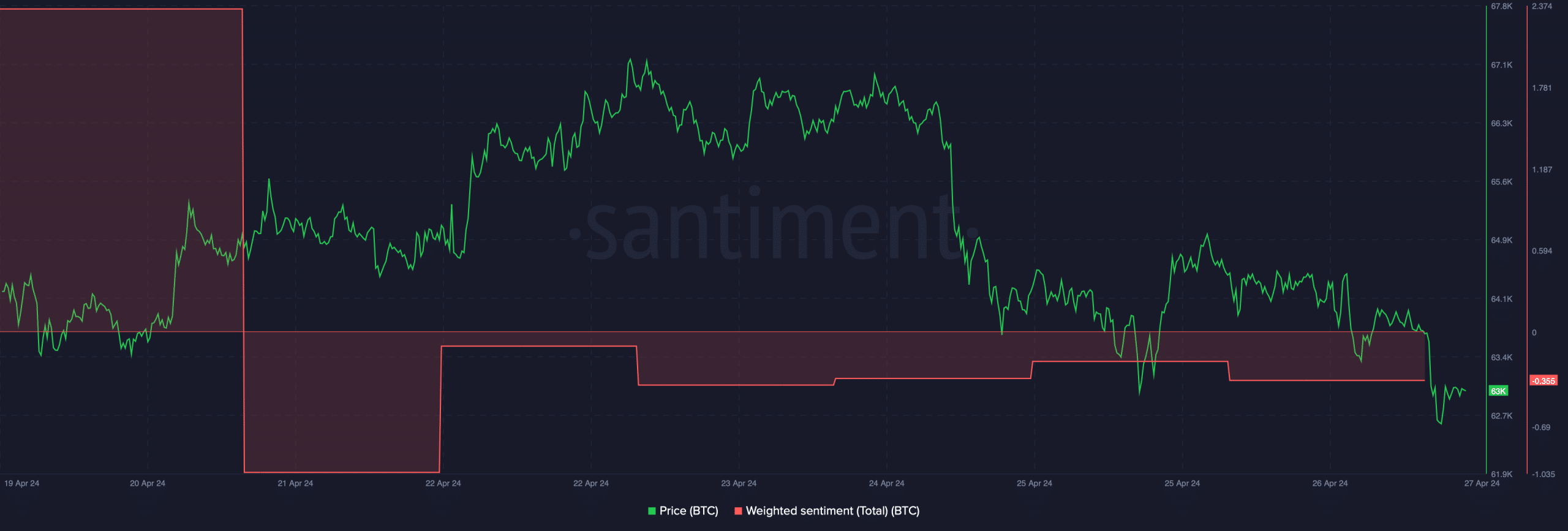

This decline also had an impact on the social metrics of the cryptocurrency. In fact, AMBCrypto’s analysis of Santiment data revealed that BTC weighted sentiment has entered negative territory – a sign that bearish sentiment has retained dominance in the market.

Source: Santiment

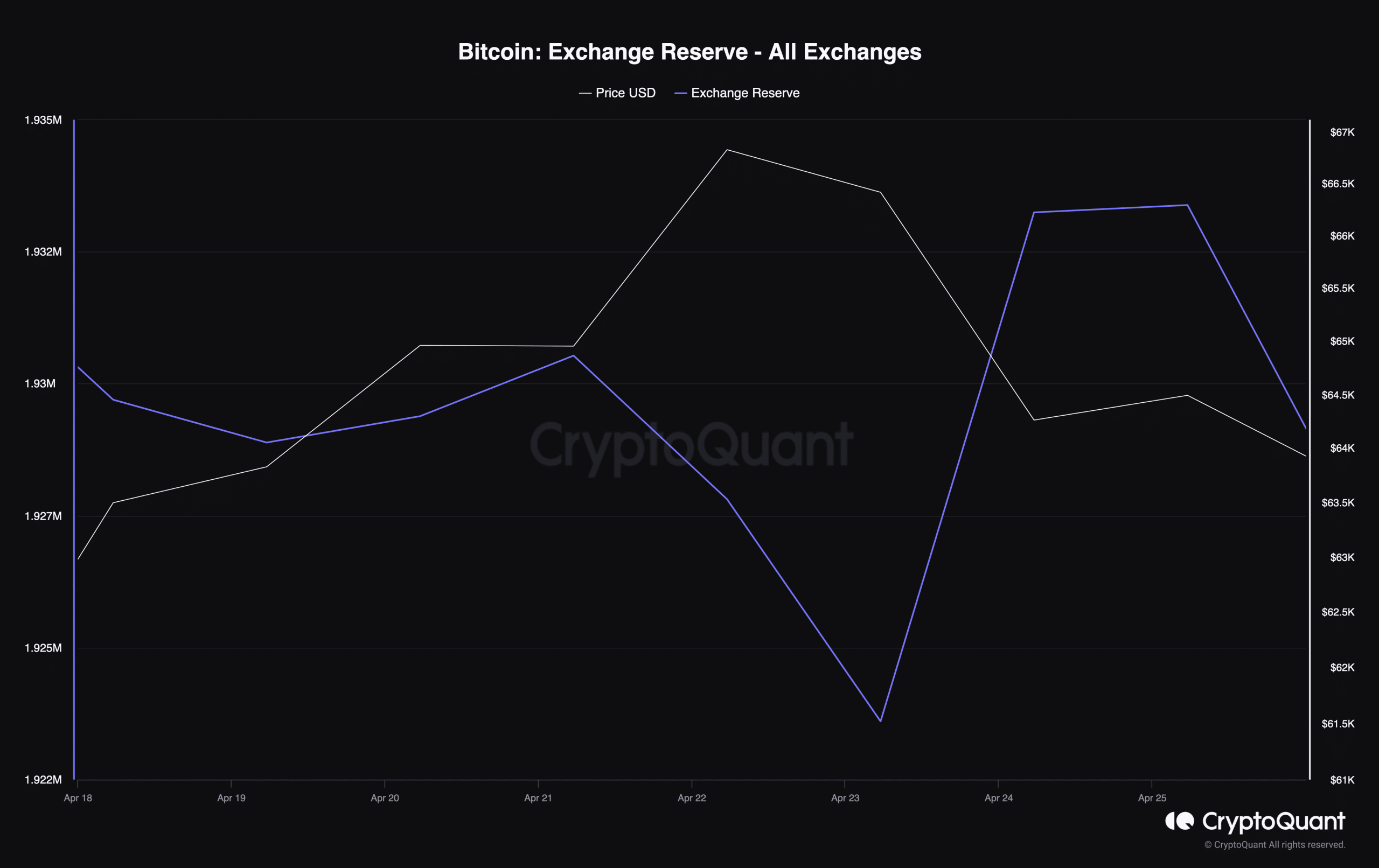

Additionally, Phi Deltalytics, an author and analyst at CryptoQuant, recently weighed in analysis Highlighting an interesting development, which may be the reason behind the recent decline in BTC prices.

According to the analysis, Bitcoin exchange flows recorded a significant increase.

The rise represents a significant portion of the total exchange flows, indicating significant profit taking by whales amid Bitcoin's bull run in 2024. If we take historical data into account, whenever this metric has risen in the past, price corrections have followed on multiple occasions.

Source: Cryptoquant

Will Bitcoin fall further?

Since the price of BTC has already turned bearish, AMBCrypto has been checking its metrics to see if another downtrend is inevitable. According to CryptoQuant Databuying sentiment was weak among US and Korean investors, with Coinbase's Bitcoin and Korea Premiums also looking in the red.

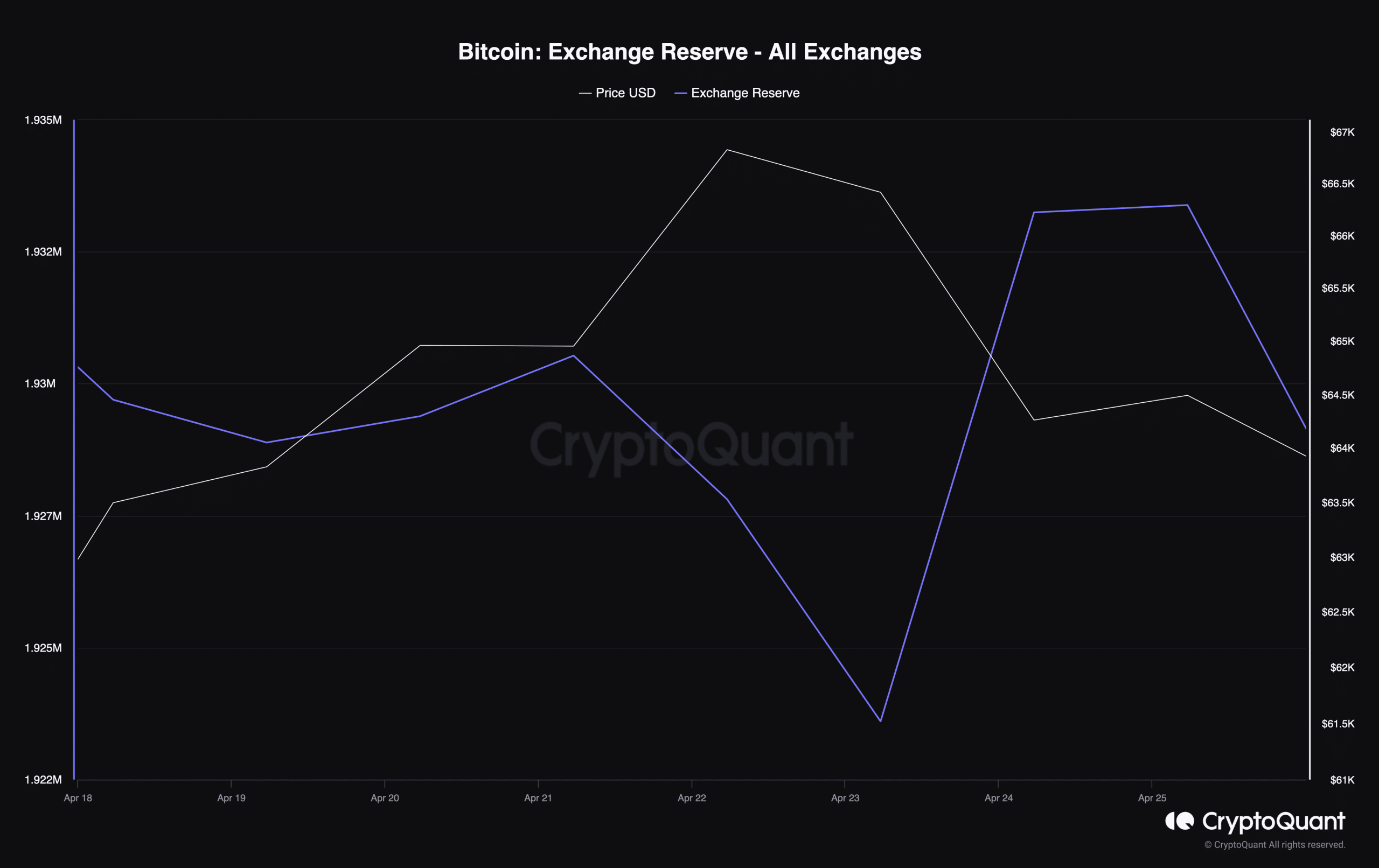

The good news here is that after the big rally that occurred on April 24, Bitcoin's exchange reserves have started to decline – a sign that the selling pressure on the king of cryptocurrencies is decreasing.

Source: Cryptoquant

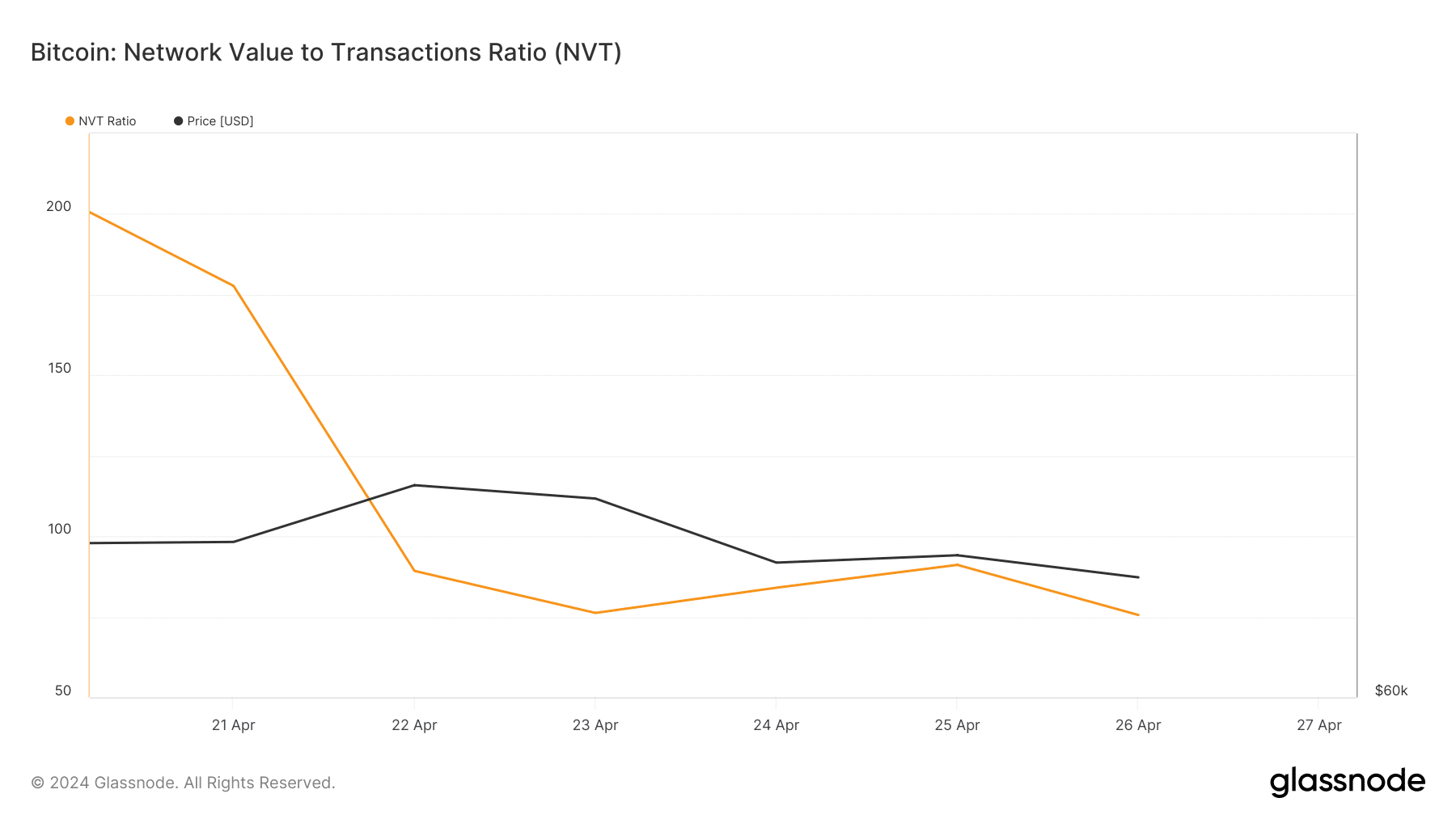

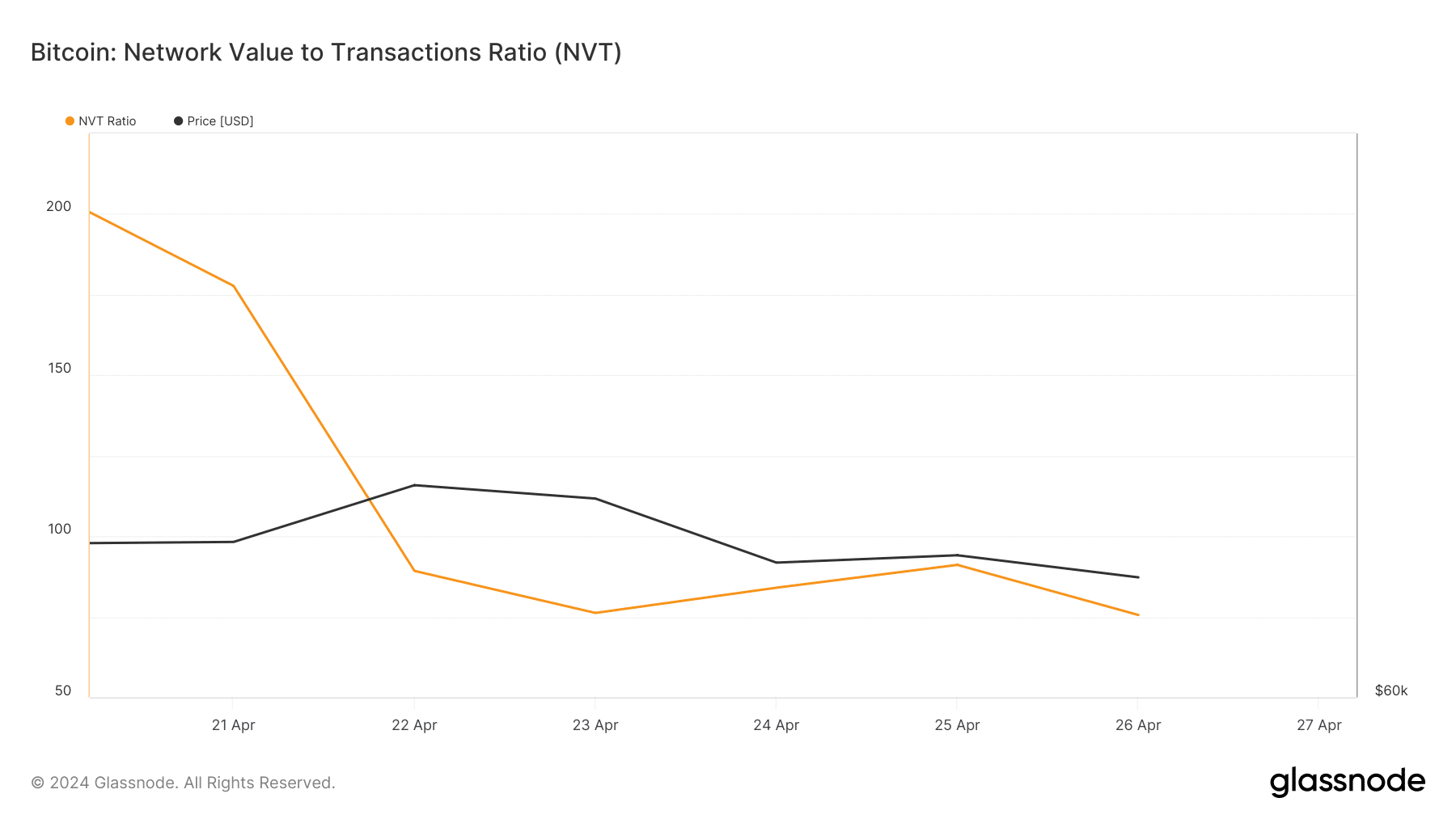

AMBCrypto's monitoring of Glassnode data pointed to another bullish signal.

BTC's network-to-value (NVT) ratio recorded a sharp decline. For starters, the NVT ratio is calculated by dividing the market cap by the on-chain converted volume measured in USD.

Source: Glassnode

The lower the gauge, the more it indicates that the asset is undervalued. On this occasion, she noted that the chances of the BTC price rising were high.

In fact, AMBCrypto recently mentioned The well-trained AI model predicted that the price of BTC will reach $77,000 within the next 30 days.

is reading Bitcoin [BTC] Price prediction 2024 -2025

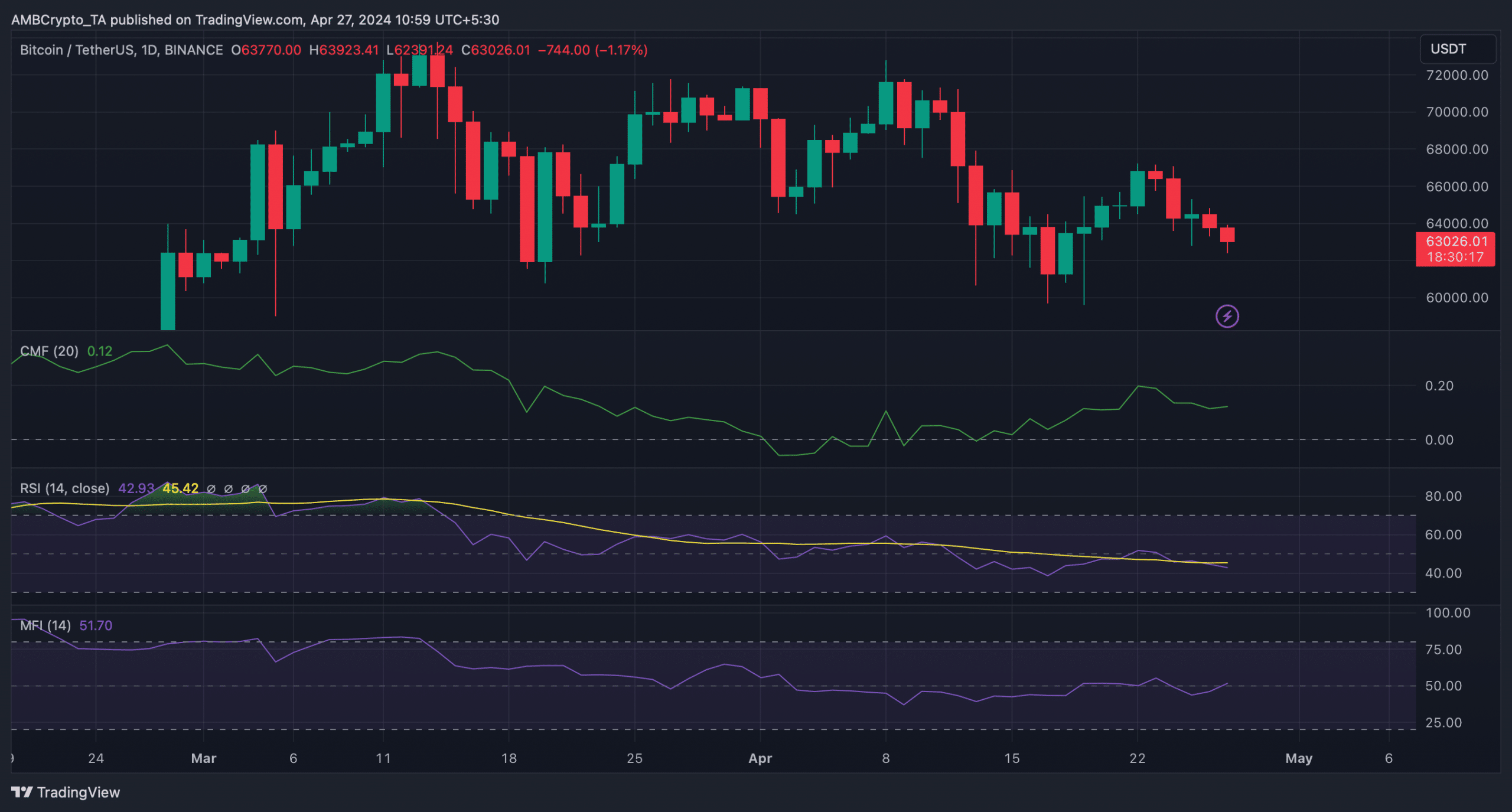

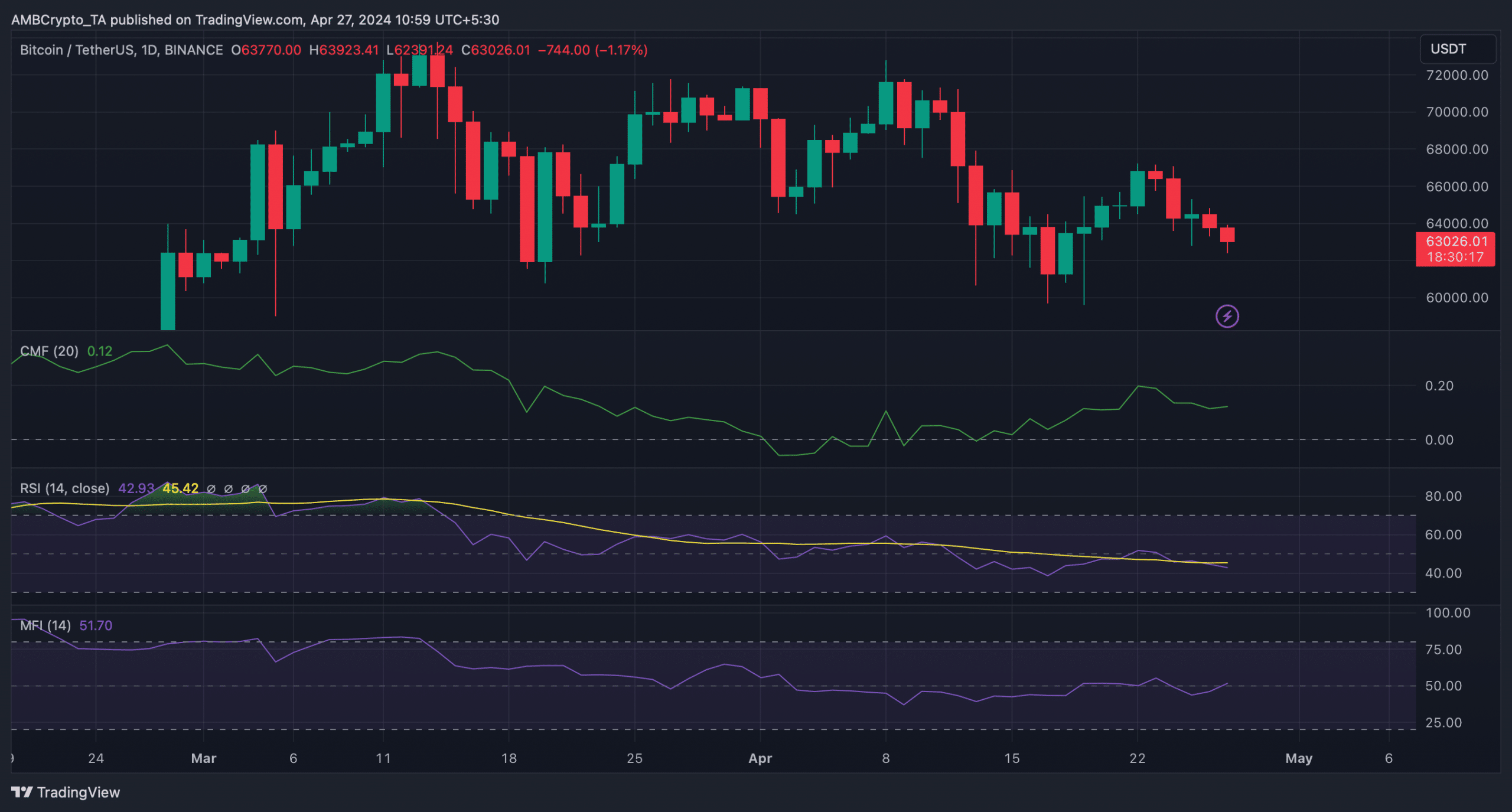

AMBCrypto then analyzed Bitcoin's daily chart to better understand if an uptrend was likely. BTC's Money Flow Index (MFI) registered a slight increase and headed above the neutral mark. Chaikin Funds Flow (CMF) was also well above the neutral mark of 0.

These indicators suggest that the BTC price chart may soon turn green again. However, the Relative Strength Index (RSI) looked bearish as it headed south.

Source: Trading View

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”