Open Editor's Digest for free

Rula Khalaf, editor of the Financial Times, picks her favorite stories in this weekly newsletter.

US employers added 303,000 jobs in March, as a rebound in the labor market dampened expectations of imminent interest rate cuts by the Federal Reserve and supported President Joe Biden's re-election bid.

The numbers published by the US Labor Department on Friday were much stronger than the 200,000 job gains expected by economists polled by Reuters, and higher than those for January and February.

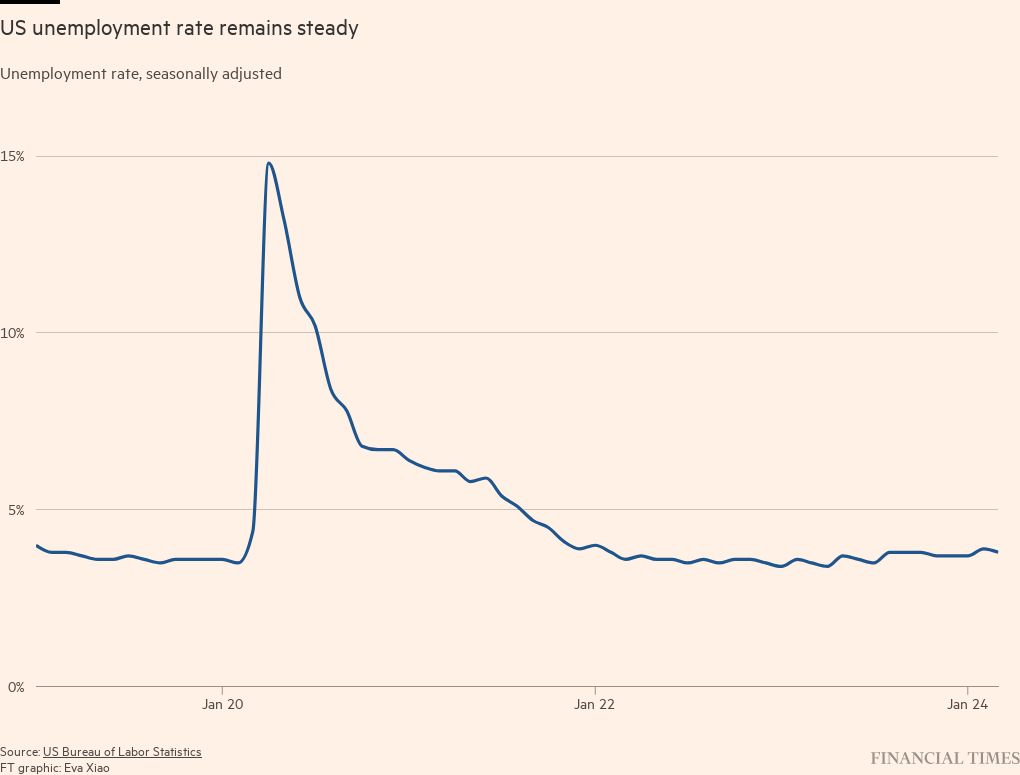

The unemployment rate fell to 3.8 percent, compared to expectations of 3.9 percent.

This data comes at a time when the Federal Reserve is considering when to start reducing interest rates from their current range between 5.25 percent and 5.5 percent.

Bond yields rose after the release, as investors scaled back bets that the Fed will cut interest rates three times this year. The two-year Treasury yield, which moves with interest rate expectations, rose 0.08 percentage point on the day to 4.72 percent.

Futures markets are now pointing to a roughly 60 percent chance of a first rate cut by June, down from more than 70 percent before Friday's data.

“It is clear that the Fed is not going to cut rates soon with jobs this strong and fundamental next week [consumer price index] “It is likely to remain hot,” said James Knightley, chief international economist at ING.

These numbers give Biden a boost as he intensifies his campaign to regain the White House, touting his strong record on job creation. But opinion polls showed that voters were dissatisfied with his economic performance, mainly due to high inflation during his first term.

Strong jobs data and higher-than-expected inflation numbers in recent months have prompted the Federal Reserve to signal there is no rush to start cutting interest rates.

This week, Federal Reserve Chairman Jay Powell said the economic outlook “has not changed fundamentally.” But he added that he needed “more confidence” that inflation falls to the central bank's 2 per cent target before cutting interest rates, saying there was “time” to evaluate the decision.

“It's hard to look at this report and say, 'The economy needs to cut rates.'” But the Fed said it wants to cut rates, said Dean McKee, chief economist at Point72.

“I don't think this significantly reduces the chances that the Fed will cut interest rates in June, because the Fed has said that depends on the inflation data,” he added. He added that Powell does not see a strong labor market interfering with rate cuts as long as inflation Decline.

Economists have warned that the monthly jobs numbers could be revised significantly over time, but the changes in January and February in the March report added a total of 22,000 jobs, reinforcing the picture of a stronger labor market.

The monthly jobs report will become increasingly important to Biden's re-election chances as the November vote approaches.

“Today’s report represents a milestone in America’s comeback,” Biden said before a visit to Baltimore, Maryland, where a bridge collapse last month killed six workers at one of the largest commercial ports on the East Coast.

Biden added that the US economy has added more than 15 million jobs since he took office. “It means 15 million more people have the dignity and respect that comes with a paycheck,” he added.

Employment growth was particularly strong in the healthcare, leisure, hospitality and construction sectors, as well as in government jobs. Average weekly earnings and hours worked continued to rise last month.

The separate household survey showed an increase of 469,000 people in the US labor force, and an increase in the labor force participation rate. Economists say this will also strengthen the Fed's case for delaying interest rate cuts.

“The remarkable strength of the US labor market, persistent stubborn inflation, and continued easing of financial conditions undermine the case for imminent interest rate cuts,” said Eswar Prasad, professor of economics at Cornell University.

“The Fed has the luxury of waiting to ease monetary policy but is also constrained by sticky inflation dynamics, making it very difficult to predict the ideal moment to start cutting interest rates,” he added.

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”