Quantitative tightening has removed 38% of Treasuries and 27% of mortgage-backed Treasuries that QE added during the pandemic.

Written by Wolf Richter for WOLF STREET.

Total assets on the Fed's balance sheet fell by $77 billion in April, to $7.36 trillion, the lowest level since December 2020, according to the Fed's weekly balance sheet today. Since the end of quantitative easing in April 2022, the Fed has lost $1.60 trillion.

After months of talking about this, the Fed has now officially clarified when, how and to what extent it will slow the QT interval. They are trying to reduce the balance sheet as much as possible without inflating anything, and they will do it easily, that is the hope.

- Starts in June

- The maximum Treasury outflow was reduced to $25 billion from $60 billion

- The runoff cap for MBS remains unchanged at $35 billion

- If Mohammed bin Salman runs out of money faster than $35 billion a month, the surplus will be replaced by Treasury securities, not Mohammed bin Salman.

- Mohammed bin Salman will essentially disappear from the balance sheet in the “long term.”

Qt by category.

Treasury bills: – $57 billion in April – $1.25 trillion from the peak in June 2022, to $4.52 trillion, the lowest level since October 2020.

The Fed has now dumped 38% of the $3.27 trillion in Treasuries it added during its pandemic quantitative easing program.

Treasuries (2- to 10-year securities) and Treasury bonds (20- and 30-year securities) “roll” the balance sheet in the middle of the month and at the end of the month when they mature and the Fed gets the face value paid. The maximum rollover is $60 billion per month, and that amount has been reduced by roughly, deducting the inflation protection the Fed gains on Treasury Inflation Protected Securities (TIPS) which is added to the TIPS principal.

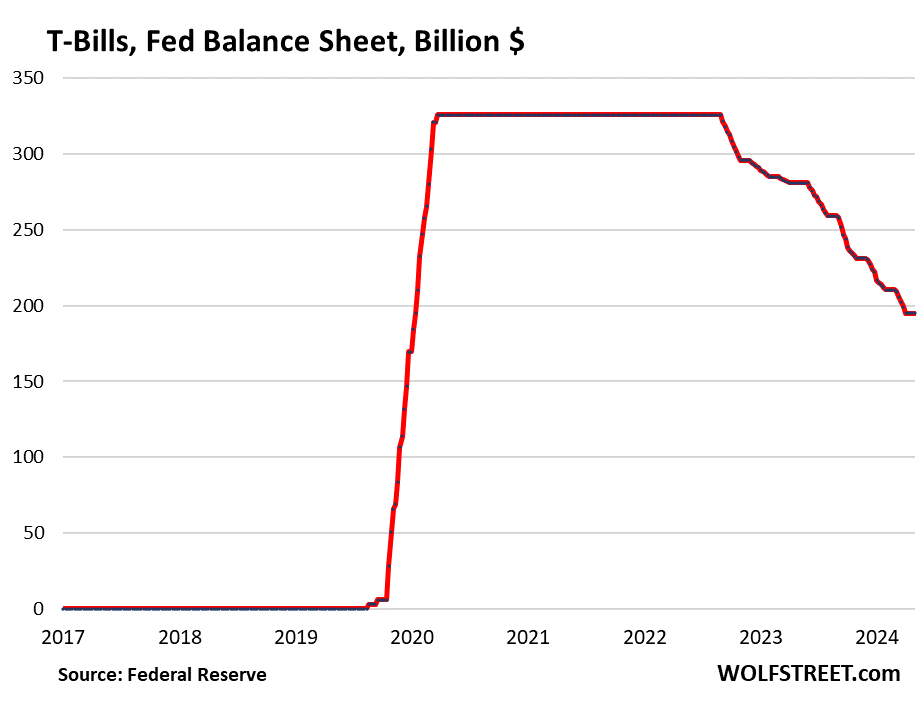

Treasury bills. Unchanged in April at $195 billion. These securities with terms of up to one year are included in the $4.52 trillion in Treasury securities on the Federal Reserve's balance sheet. But they play a special role in QT.

The Fed allows them to be issued (it does not replace them when they mature) only if there are not enough long-term Treasuries to reach the $60 billion monthly cap. This has allowed the Fed to offload about $60 billion in Treasury bonds each month.

From March 2020 until the QT period increased, the Fed held $326 billion in Treasury bills that it continually replaced as they matured (solid line in chart below).

The slowest QT begins in June You will follow the same principle with treasury bills. But the first month that Treasury allocations fall below the new $25 billion cap is September 2025 ($17 billion). So Treasury bills on the balance sheet will remain unchanged at $195 billion until then, even as securities and bonds emerge:

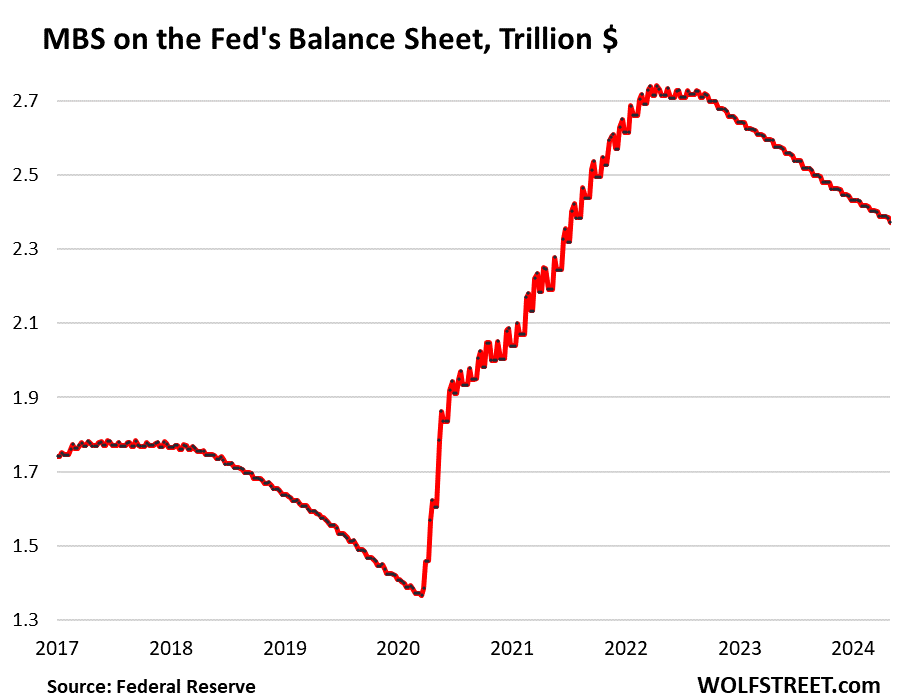

Mortgage Backed Securities (MBS): – $16 billion in April – $368 billion from the peak, to $2.37 trillion, the lowest level since July 2021. The Fed gave up 27% of mortgage-backed loans it added during pandemic quantitative easing.

MBS are taken off the balance sheet primarily through pass-through principal payments that owners receive when the mortgage is paid off (mortgaged homes are sold, mortgages are refinanced) and when mortgage payments are made.

But existing home sales fell, mortgage refinancings collapsed so fewer mortgages were paid off, principal principal payments to mortgage bond holders, such as the Fed, fell dramatically, and MBS came out of balance at a much slower pace. From the maximum of $35 billion.

Under QT is slower Starting in June, the cap on MBS will remain at $35 billion. When the housing market comes out of the freeze, and sales volume rises to more normal levels, mortgage yields will increase, so principal payments to mortgage bond holders will increase, rollovers of mortgage bonds will increase from current levels, and the curve in the chart below will steepen.

If pass-through capital payments exceed $35 billion — during the pandemic housing boom, they exceeded $110 billion in several months — the excess will be replaced by Treasury securities, not mortgage-backed Treasuries, as the Fed wants to phase out mortgage-backed Treasuries. on its balance sheet.

Bank liquidity facilities.

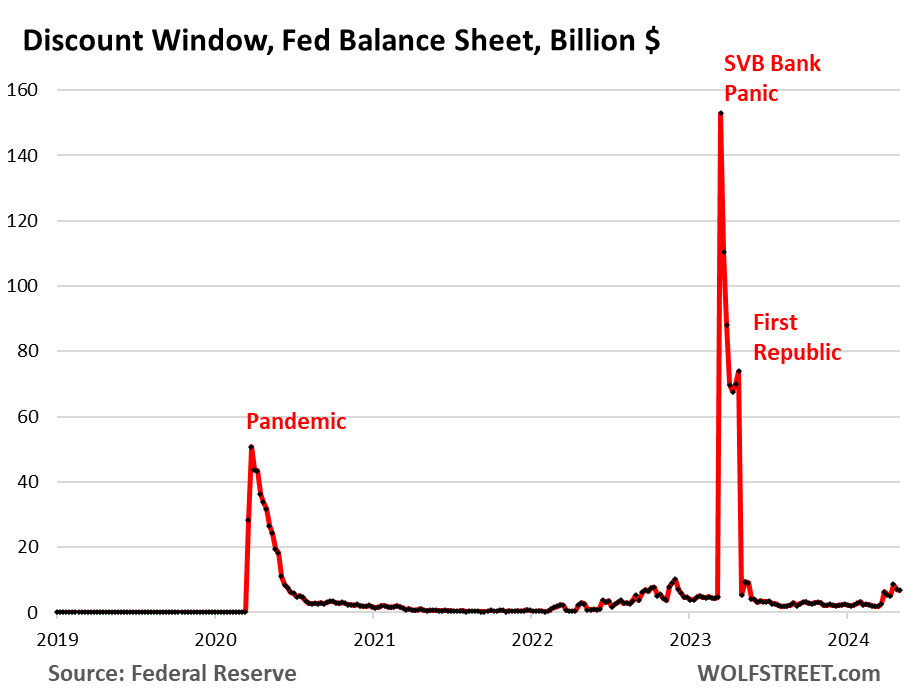

Discount window: + $1.3 billion in April, to $6.8 billion. During the March 2023 banking panic, loans briefly rose to $153 billion.

The discount window is the Fed's classic liquidity offer to banks. The Fed currently charges banks 5.5% interest on these loans – one of five interest rates – and requires market value collateral, which is expensive money for banks, and there is a stigma attached to borrowing in the discount window, so banks don't do it. They only use this facility if they need to, although the Fed urges them to use this facility more regularly.

Bank Term Finance Program (BTFP): – $6.4 billion in April to $124 billion.

Cobbled together over a panicked weekend in March 2023 after the failure of SVB, BTFP had a fatal flaw: its price was dependent on the market price. When the interest rate-cutting mania began in November 2023, market rates fell even as the Fed held interest rates steady, including the 5.4% it pays banks on reserves. Some smaller banks then used the BTFP to make arbitrage profits, borrowing from the BTFP at a lower market rate and then leaving the cash in their reserve account with the Fed to earn 5.4%. This arbitrage caused BTFP balances to rise to $168 billion.

Frustrated with seeing BTFP being misused to make profits, the Fed shut down the arbitrage opportunity in January by changing the rate. It also allowed the BTFP to expire on March 11. Loans obtained before March 11 can still be implemented for a year. By March 11, 2025, BTFP will be zero.

Balance sheet after 12 months of QT slowdown.

In May, the Fed intends to shed another $75 billion in assets, which would reduce the balance sheet to roughly $7.28 trillion. In June, the slower QT begins. After the first 12 months of slower QT, by the end of May 2025, total assets may be lower by these amounts:

- If MBS's principal payments continue at $15 billion per month, rather than accelerating, it will remove $180 billion by the end of May 2025.

- Subtracting $25 billion from the Treasury would remove $300 billion by the end of May 2025.

- The BTFP will reach zero by March 2025, raising $124 billion.

- Unconsumed premiums amount to $2.2 billion per month, or $26 billion in 12 months.

- Total: Minus $630 billion by the end of May 2025.

Therefore, without an acceleration of the MBS rollout, the balance sheet will decline to approximately $6.63 trillion by the end of May 2025.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate that very much. Click on the beer and iced tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Register here.

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”