- Interest in Bitcoin ETFs has grown, as indicated by rising inflows

- Whale interest in BTC also rose while retail investors took profits

Bitcoin [BTC] It has been stagnant around the $67,000 level for some time now. However, interest in BTC on the charts has not decreased. In fact, recent data suggests that, on the contrary, interest in Bitcoin ETFs has surged over the past few days.

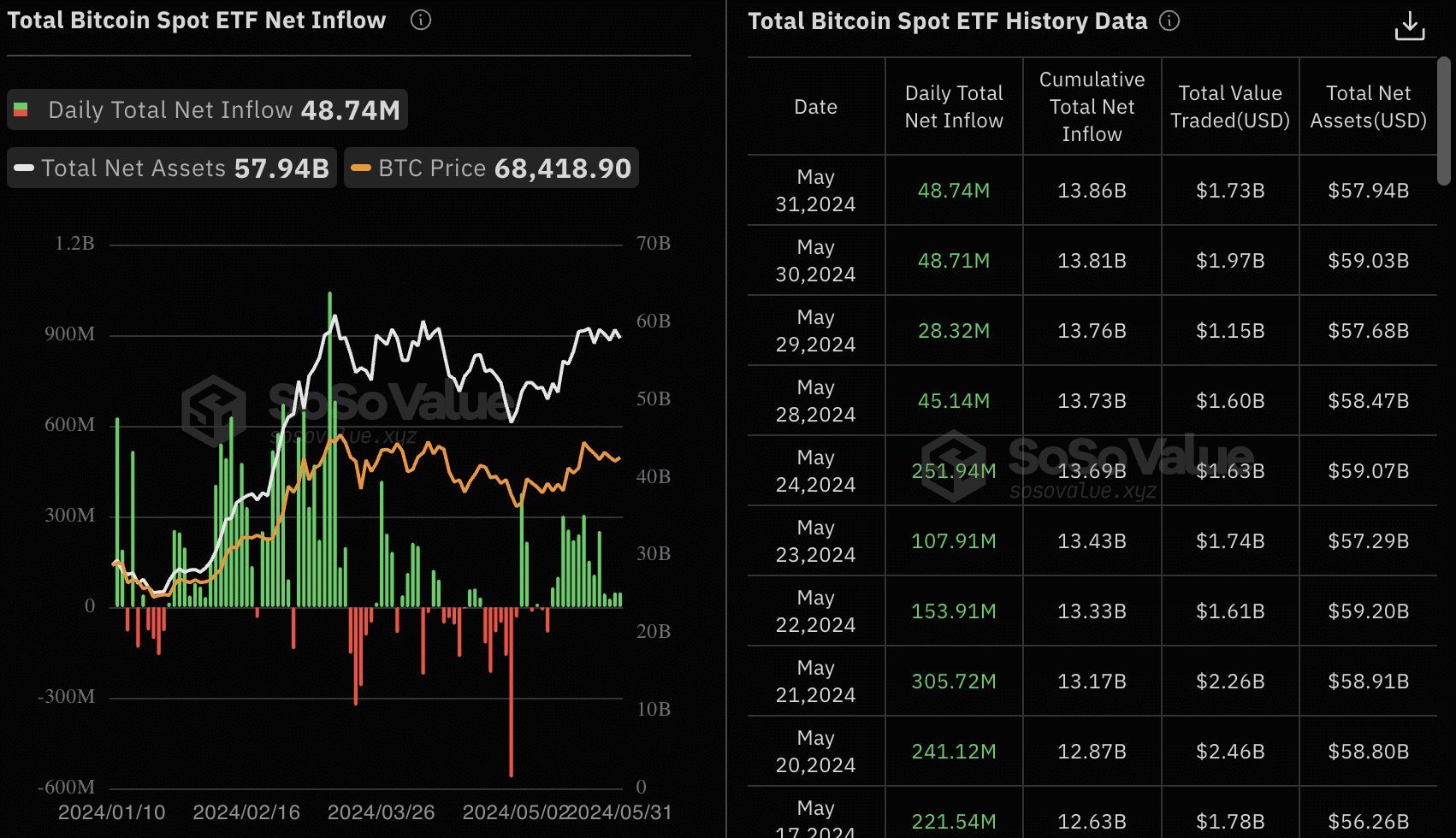

Bitcoin ETF inflows are on the rise

Spot Bitcoin ETFs continued to attract investors on May 31, with total net inflows of $48.74 million. This marks the 14th consecutive day of net inflows for these funds, indicating continued investor interest in gaining exposure to Bitcoin through financial products available in fiat markets.

However, inflows are not evenly distributed across all Bitcoin ETFs. Grayscale’s GBTC recorded net outflows of $124 million, while BlackRock’s IBIT and Fidelity’s FBTC saw inflows of $169 million and $5.9047 million, respectively. This indicates that investors are changing their preferences in favor of new entrants in the Bitcoin ETF market.

Source: SosoValue

The growing interest in BTC ETFs indicates that users who are not primarily from the cryptocurrency space per se have also shown interest in the cryptocurrency. If this trend continues, it could lead to Bitcoin becoming more mainstream, increasing its adoption as well.

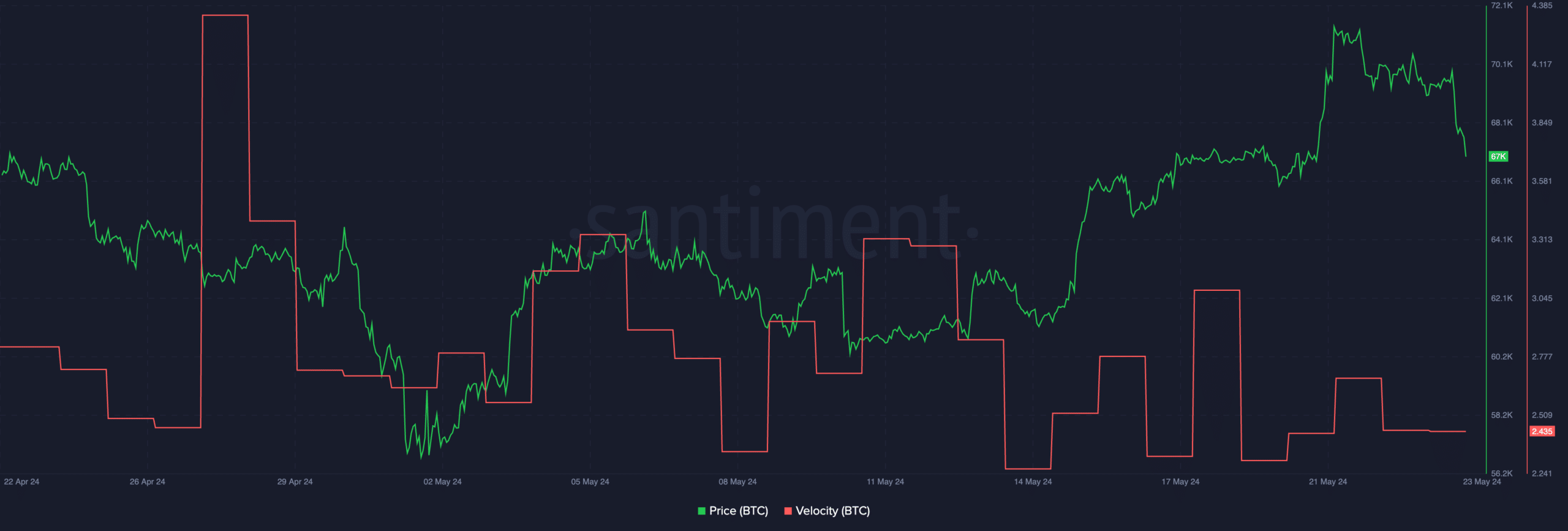

At the time of writing, Bitcoin was trading at $67,732.76 with mark up 1.43% in the last 24 hours. Bitcoin’s speed decreased materially during this period, indicating a slowdown in Bitcoin transfers. This also means that most addresses were willing to hold their Bitcoin.

Source: Santiment

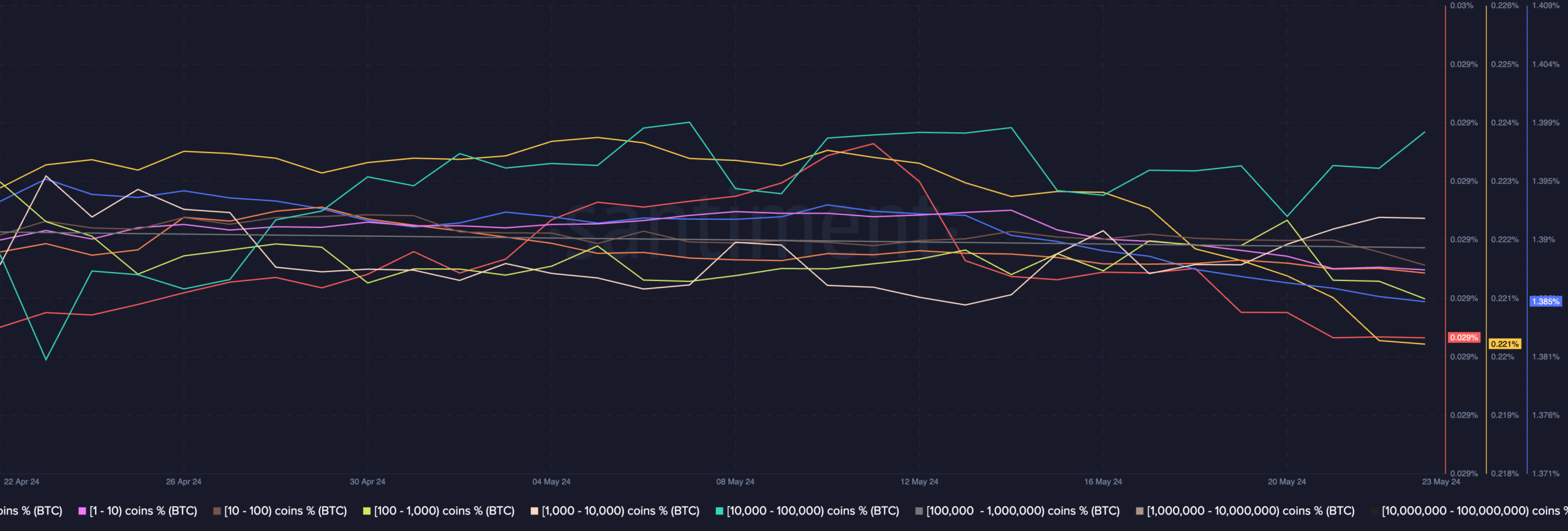

AMBCrypto’s analysis of Santiment data also revealed that whale interest in BTC has increased significantly over the past few days. Having a large amount of whale interest could cause the price of BTC to rise in the future. However, retail interest in Bitcoin declined significantly over the same period, suggesting that not all coin holders were equally bullish.

Read Bitcoin (BTC) Price Predictions 2024-25

If retail investors continue to sell off their holdings, this could increase downward pressure on Bitcoin price charts.

Source: Santiment

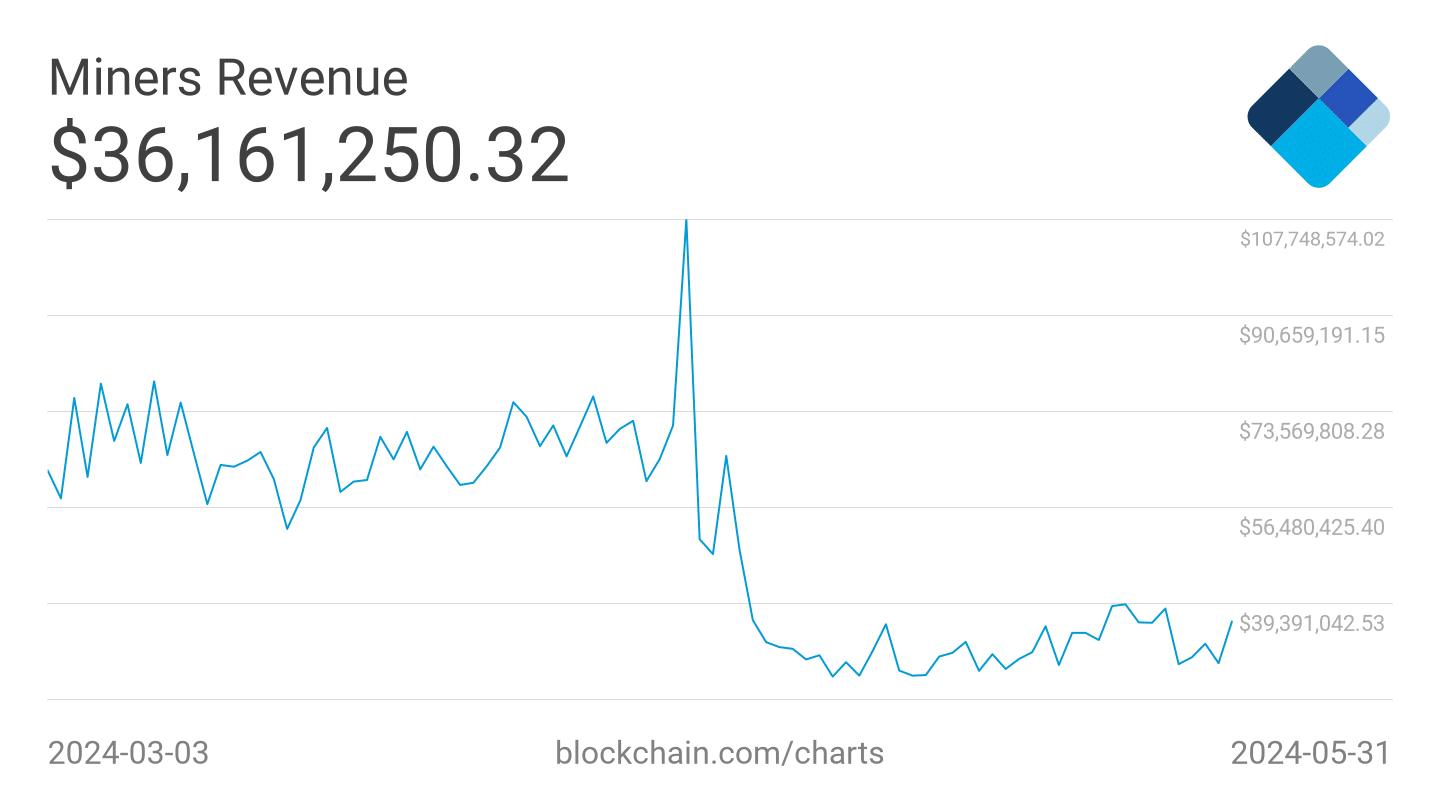

Another factor that could affect the selling pressure on BTC is the condition of miners.

According to recent data, miners’ revenues have declined over the past few weeks. Miners will have to sell their holdings to remain profitable – contributing to increased selling pressure on Bitcoin.

Source: Blockchain

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”